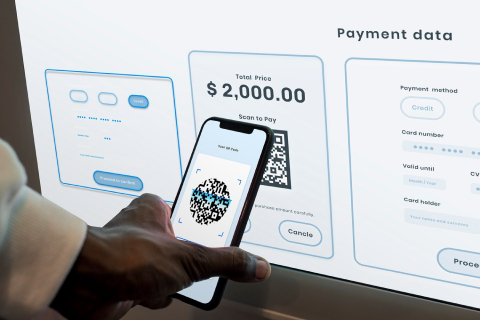

Browse Our Website

At Crown Gold Bank, we’ve designed our website to provide you with a simple, seamless, and informative experience. Whether you’re looking to open an account, explore our financial products, or access banking services, everything you need is just a click away. Our user-friendly interface ensures that you can easily find what you’re looking for, whenever you need it.